When the Federal Reserve increases interest rates by more in a year than it has in the prior decade, there is bound to be some turmoil. In an attempt to curb rapidly rising inflation and stave off a recession, the Fed’s actions have dropped a hammer on the real estate markets — both residential and commercial — with a dramatic increase to the cost to borrow funds.

After over a decade of unprecedented value creation in real estate, it was beginning to feel like the party may never end. Before declaring “real estate” a troubled asset class, it’s worth looking independently at the multifamily sector. Less qualified homebuyers are generally a positive for keeping rents high and vacancy rates low. Many multifamily buyers have complained over the last year that low interest rates had made it impossible to find deals. But with signs pointing in a number of directions, one thing is for sure, as we attempt to plan for the year ahead it’s hard to know whether to feel cautiously optimistic or recklessly pessimistic.

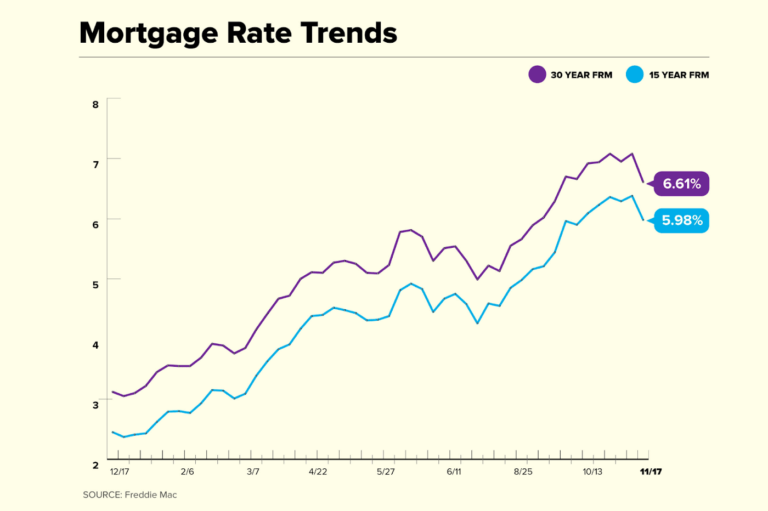

Interest Rates Soaring Have Hit The Home Buying Market Especially Hard

The Fed’s most recent increase to interest rates — a 75 bps (CNBC) bump — has made it a total of + 3% in a 6-month period and + 3.75% for the year (Forbes). In October mortgage rates soared above 7% for the first time in 20 years (NBC) before pulling back slightly in November. The cost to borrow has doubled from this time last year, most dramatically impacting affordability, and resulting in more inventory on the market and a longer time to sell.

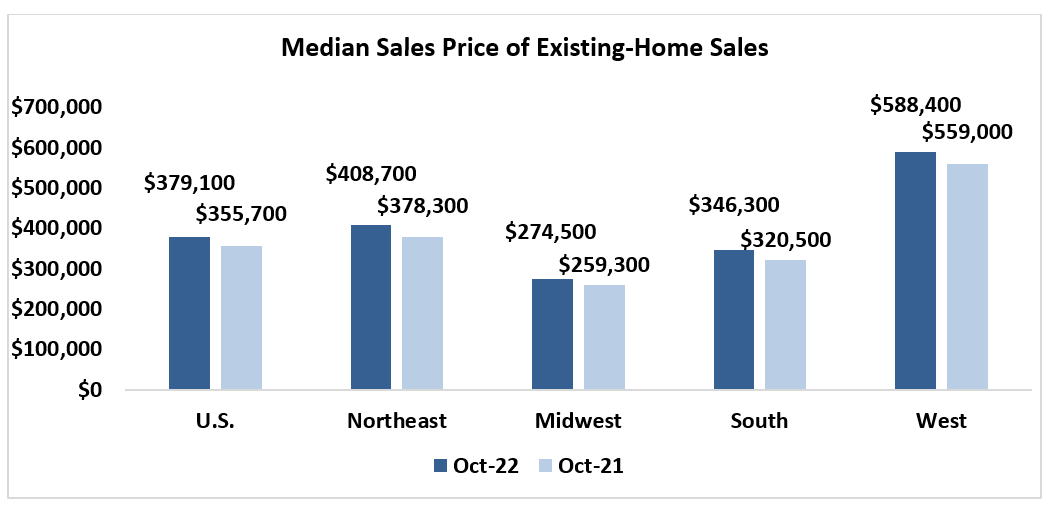

Home prices are experiencing their fastest value deceleration in history — which means that while prices are still higher year-over-year (Case Shiller Index), they are rising at a lower rate.

Several macro factors are significantly different from the last real estate downturn — the housing market remains significantly supply-constrained (Fannie Mae), employment numbers are strong (CNBC), and mortgage lending parameters remained stringent. All factors suggest that while home sales will struggle in many markets over the next +/- twelve months, a significant drop in home values nationwide is not anticipated.

Multifamily Feels Some Pain as Rent Growth Subsides and Sales Struggle

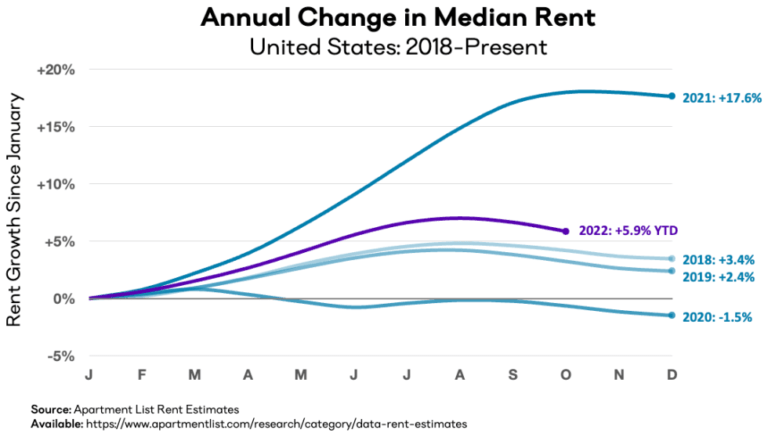

Market volatility and uncertainty are having some impact on the multifamily sector. Rents have begun to cool, dropping in September for the first time in two years after climbing to record highs (WSJ) and then again in October. It bears noting that this is consistent with seasonal trends and rent growth in 2022 continues to trend faster than in pre-pandemic years with rent growth still at 5.9% YTD (Apartment List). Landlords polled say that they still plan to increase rents in the coming months, albeit at a lower rate than previously planned (Realtor.com).

Overall national multifamily sales volume surpassed $101 billion in the first six months of 2022 — a $34 billion increase year over year — with an average price per unit increase of 28.4% (Multifamily Housing News), but since the interest rate hikes began, many report that Apartment sales have become “challenging” (Multifamily Executive) to say the least. Buyers and sellers are now in a period of stasis with bid/ask disparity and the Mortgage Banker’s Association (MBA) projects an overall 7% decline in multifamily lending for the year, reflecting a very different second half of 2022. Still, the current housing under-supply, coupled with a 9% year-over-year drop in construction starts (Fortune), suggest vacancy rates and cap rates will remain low in most markets for the immediate future (US News).

Looking Ahead

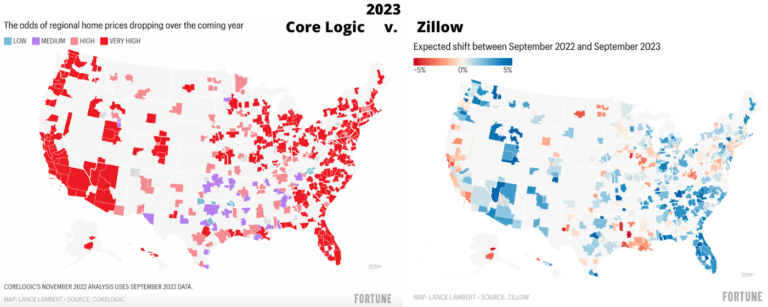

Views regarding the overall picture of 2023 seem pretty consistent; conditions will be largely dependent upon whether inflation is brought under control (Forbes). Corelogic is bearish on home prices for 2023 (Fortune) whereas Zillow is more bullish, anticipating rents will outpace inflation over the next 12 months, but also landing on 2023 being a “buyer’s market” for residential home sales (Builder’s Online). While some have concluded that a recession isn’t imminent (CoStar), some are less optimistic (Fannie Mae), and still others anticipate it will be a close call (Goldman 2023). Regardless of whether an official recession is in the cards, most agree we are all in for some rough months ahead.

We invite you to subscribe to our newsletter for updates and industry news.